For the past few days, readers of any major Finance and Economics site have been unable to avoid the absolute drama related to the Yuan’s depreciation of almost 3% in two days. This type of currency devaluation hasn’t been witnessed in over two decades.

Now to the principle domestic and global repercussions of China’s artificial currency devaluation.

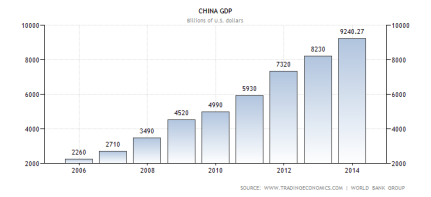

1. Implications for GDP & Export volume: Relative to the previous five years, China has been struggling to maintain speed in export volume as well as overall GDP growth. This is partly due to the Yuan’s gaining strength in the global market. As a result of appreciation, countries generally experience a decrease in trade surpluses. In addition to the natural appreciation of currency, China is also experiencing a smaller trade surplus each year due to higher consumption rates and needs for foreign goods in its own domestic markets. In today’s economy, an 8% GPD growth is not sustainable. Past experiences have illustrated time and time again that economies must slow to around a 2-3% annual growth rate to maintain stability (while also holding a strong middle class for consumption needs).

2. Implications for Domestic and International Markets: Unlike many other currencies, the Yuan’s rate is an “official midpoint” which guides market trade with variability of an increase or decrease of 2% throughout the day. China’s central bank has made it clear that they do not anticipate a downward trend of the Yuan’s value but instead state that this is purely an adjustment. As mentioned in my previous article, there will be positive and negative repercussions via this decrease.

Positive impacts: Chinese exporters will certainly benefit from this currency decrease as global consumers will be required to pay relatively less for goods and services. Tourists wishing to visit China will also require a lighter wallet while traveling across the red kingdom due to decreased domestic prices relative to foreign currencies.

Negative Impacts: Domestic Chinese consumers will be less likely to purchase the relatively more expensive foreign goods. This will also hurt foreign exporters and retailers attempting to enter or remain in the Chinese consumer market. Chinese companies will also experience higher interest rates when paying off foreign debt in dollars or other currencies.

3. Implications for investment to service economy: At this point, China is reaching a threshold which all developing nations much bridge at one time or another. the country’s economy has been racing along with high GDP, export volume, and private investment. Unfortunately, the next step is one of the most difficult. This, of course, is transitioning over to a service economy. Currently structured as a strong manufacturing and investment outlet, China’s economy has been expanding rapidly over the past decade. Now China must transform into a more stable system, offering high-skilled labor and quality goods.The growth and export driven model has been exhausted and it’s now time for China to consider the long-run.

4: Implications for Yuan and SDR : The international Monetary Fund (IMF) dubs certain currencies to be so important to the stability of the global economy that they are issued Special Drawing Rights (SDR). This implicitly means that member countries around the world must hold reserves of each currency in a “basket”. The weight of these currencies collectively value the (SDR) asset reserve. China wishes for the Yuan to be a part of the Special Drawing Rights as it will likely offer prestige and signal reliability in the marketplace. Still, the IMF has recently stated that the Yuan’s devaluation will not effect its chances of being selected.

5. Implications for consumption : China has indicated that the administration is more concerned about export and GDP growth than domestic consumption patterns. As shown by other developing nations such as the U.S. and Germany, a strong middle class is very important for economic stability. In attempts to catalyze the sputtering export economy, devaluing the Yuan has not only protected domestic producers but has also inherently decreased domestic working-class inclinations for spending. Due to higher prices for imported goods and lower purchasing power, the current economic policy is not doing any favors for domestic consumption.

To recap on what results China’s current economic policy moving forward may invoke, check out the WSJ here.