Bubbles Upon Bubbles

Are we expected to believe that an annual GDP growth of 7%-8% is sustainable? Some investors are beginning to wonder if China will be going the way of Japan, losing two decades of economic expansion as a result of devastating fall-outs. If we are to expect great things from an up-and-coming world power, China needs to address its ever-growing property bubble. Some of these plays are torn directly from Greenspan’s own notes; stimulating markets in attempts to circumvent smaller crashes. Still, China’s tech bubble is surely another example illustrating the old idiom, what goes up must come down. As The United States’ inclination toward Keynesian ideology has shown, properly guided bubbles can work with proper understanding of natural repercussions. Unfortunately, China seems to be setting itself up for some mammoth bubbles ahead.

China appears to be intentionally pushing bubbles to maturity in hopes that the end result is greater than where the market began. With some hair of the dog, this strategy is none the less dangerous to all participants.

Artificially Inflated Currency

Due to China’s high export volume, the country is holding a trade surplus. In these conditions your average nation would be experiencing appreciation of native currencies. This, in turn, would cause exports to become more expensive leading to noticeable decreases in export volume. Still, unlike other colossal economic world players, China intentionally keeps the Yuan’s strength in the dark. At first glance, the strategy could be considered admirable for a young growing economy but the whole situation makes potential investors very uncomfortable. The Communist Party of China seems adamant to reduce volatility of the Yuan by keeping specific key measures out of public view. As a result, investors are less inclined to trust a currency which holds an uncertain definitive value.

Centralized Government

While long gone from the visions of Chairman Mao, the People’s Republic of China’s economic and political structure is certainly still more centralized than other developed nations. With 22 provinces, 5 autonomic regions, 4 municipalities, and 2 special administrative regions, one may wonder how the argument is made that China’s political and economic systems are currently centrally operated. Not unlike Russia, the question is not so much how many government pieces are in play, but rather, who holds the king. Due to an overtly centralized government structure, decisions oftentimes exhibit conflict of interest; seeming to invariably favor Communist Party of China (CPC) members in capital centers. Along with an overly centralized government also comes a standard lack of follow-through in regulations and feed-back. Provinces are often found creating false metrics for the sake of embellishing reports to satisfy capital-based regulatory committees. Tendencies for Xi Jinping to strong arm smaller provinces toward unsafe labor practices in the name of economic glory are not unheard of. The key to economic and political stability in China is surely to appropriate power and proper representation toward smaller provinces, especially up-and-coming Wuhan, Chongqing, Xiamen, Ningbo, among several others.

Blatant Socio-Economic Disparities

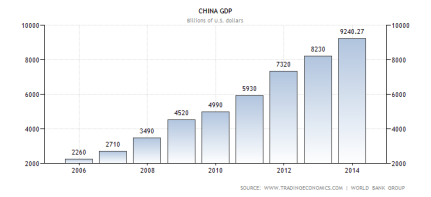

Since the late 1970’s China has witnessed an unprecedented economic growth due to manufactured exports; experiencing up to 9% GDP growth for extended periods of time. In an attempt to increase consumption the government has begun pushing rural farmers off of ancestral lands toward the cities. History has repeatedly shown nations with a strong middle-class have a tendency to maintain consistent success due to high levels of domestic consumption. The urban-rural income gap can be attributed to policies favoring industrialization in large cities, while large-scale farming has only now begun receiving government subsidies toward staple crops. Current fiscal and monetary policies favor China’s steady migration toward exports of manufactured and assembled goods, further widening wealth disparities.

Private Loan driven Construction Projects

Ghost cities containing luxury housing and countless amenities go uninhabited due to the severe lack of balanced wealth in the region. Investors speculate what will become of the ghost cities being built around China via leveraged funds. Will domestic private lenders refuse to offer the Chinese government further credit? Most likely not as private construction and real-estate agencies receive “economic incentives” from the government in a pursuit to further stimulate economic growth through “infrastructure development”. Unless China addresses its wealth disparity and moves forward to build a larger middle class, consumption will remain low and the cities will remain uninhabited.

Patent Law Rarely Enforced

The accepted principle of the game is truly based on saving face. Due to the borderline non-existent enforcement of patent law (especially with international corporations) potential investors are hesitant to set up Green Field projects, much less joint-ventures. In an attempt to increase domestic investment, China allows investors to introduce new international non-native brands to the Chinese demographic if the company agrees to partner with a Chinese firm for the project. Oftentimes, these scenarios result in the theft of patented procedures and goods. Because of a seemingly non-existent patent law enforcement procedure, foreign companies find themselves market shaming Chinese companies into not using stolen information.

Conversion From “Blue Collar” to “Service” Economy

While India’s infrastructure isn’t yet admirable, the populous has made impressive strides toward becoming a well paced service economy, functioning on skilled-labor. Xi Jinping (China’s president) seems very fond of manufacturing tangibles in bulk through low-skilled labor at very low cost (for exporting). With a looming elderly population growing into their “golden years” China’s current welfare systems may not prove adequate. After installing the one child policy, the country successfully reduced birth-rates, slowing population growth to a reasonable level. Now for a bit of foresight on the matter. Unless China works out a way to convert from manufacturing labor to high-paying/ higher skilled, service and tech concentrations, younger populations may struggle to contribute adequate capital toward the sustenance of enormous elderly populations. The math is fairly simple. Either the aging population must continue working to support itself, or the weight will soon be borne by the considerably fewer “millennials”.

This was a fantastic article regarding China’s economic position, one that I really enjoyed. I especially liked the concise way in which it conveyed all the information required succinctly. I’m a 15 year old with a blog on finance and economics at shreysfinanceblog.com. It would be very much appreciated if you could read and reblog one of my articles! Thanks again for this great article.

LikeLike